Understanding NIST Cybersecurity Framework 2.0

Introduction to NIST CSF 2.0 The acronym NIST CSF has become synonymous with cybersecurity risk management since its…

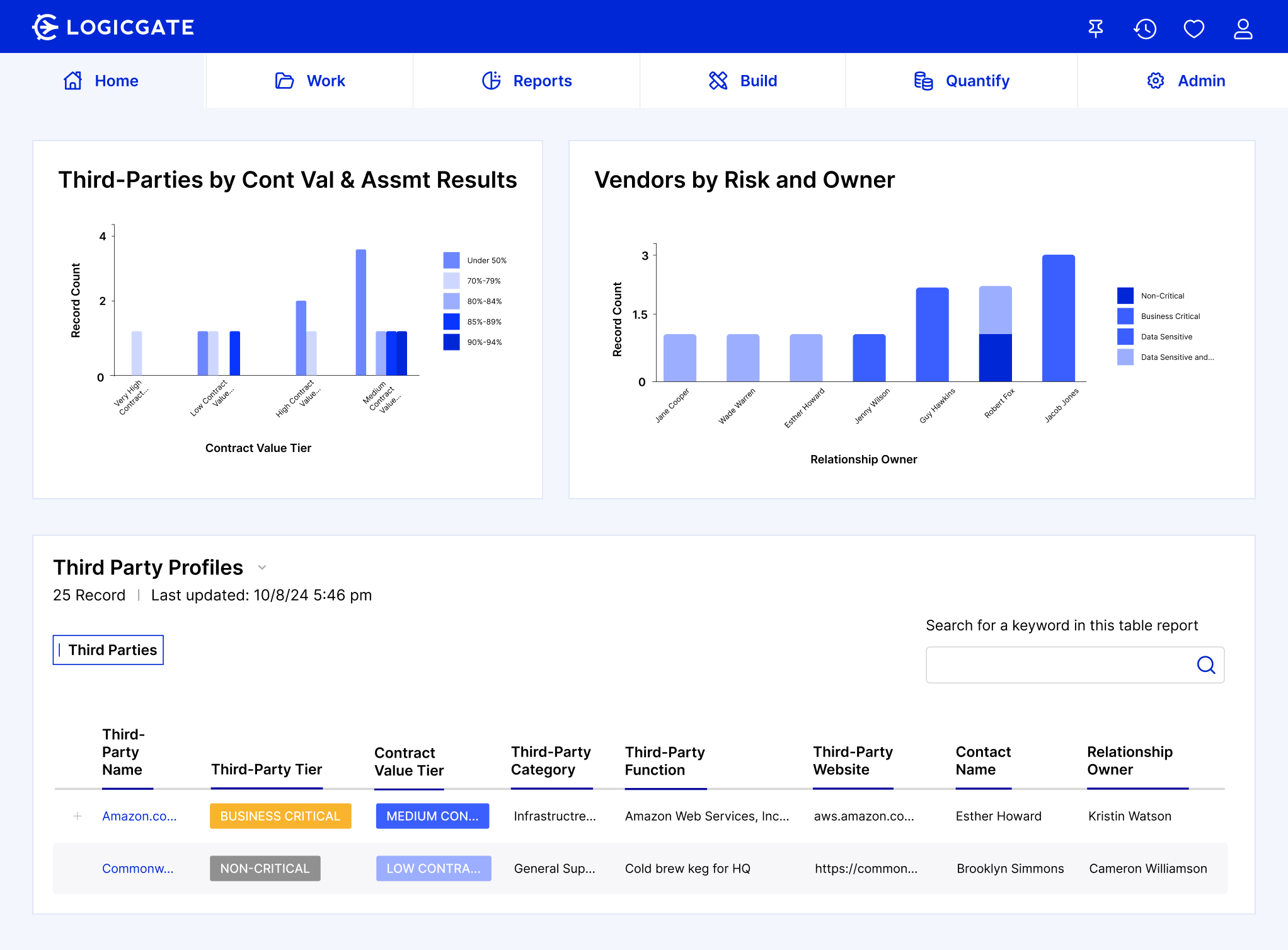

As businesses continue to rely on third-party vendors for critical services, the need for a robust third-party risk management program has never been greater. With evolving regulatory requirements, cybersecurity threats, and operational dependencies, third-party relationships introduce potential vulnerabilities that organizations must proactively manage.

Third-Party Risk Management (TPRM) is the process of identifying, assessing, mitigating, and continuously monitoring risks associated with third-party vendors. Unlike traditional vendor risk management, which primarily focuses on contractual compliance and financial stability, TPRM has evolved to address broader concerns such as cybersecurity threats, regulatory compliance, operational disruptions, and emerging technology like artificial intelligence and blockchain technology.

Today’s enterprises rely on an extensive network of vendors, suppliers, and partners, making third-party risk a critical component of business resilience. Historically, TPRM operated separately from operational or cyber risk management teams, often managed by procurement or legal. Organizations must now consider risks beyond operational continuity, such as cybersecurity breaches affecting vendor systems, regulatory scrutiny outside their normal jurisdiction, and the opaque usage of artificial intelligence. The shift from supply chain risk management to TPRM reflects the increasing complexity of vendor ecosystems and the need to centralize risk data.

At its core, third-party risk refers to the potential negative outcomes that arise from engaging external vendors, suppliers, contractors, or service providers. These risks can significantly impact an organization's operational integrity, security, financial stability, and compliance posture. Third-party risks exist because businesses depend on external entities for critical operations, often sharing sensitive data, systems access, or key infrastructure.

The different types of third-party risk include:

Organizations must implement a structured approach to assessing third-party risk, ensuring alignment with overall risk management strategies and business objectives. Traditional methods of static risk assessments are becoming obsolete. Real-time risk insights, automation, and AI-driven analysis are now essential to staying ahead of potential threats. Don’t believe me?

The SolarWinds supply chain attack in 2020 exposed thousands of organizations, including U.S. government agencies, to cyber espionage due to vulnerabilities in vendor software. This event emphasized the need for real-time risk intelligence and proactive vendor assessments to mitigate threats before they escalate into full-scale security breaches.

These examples highlight why businesses must move beyond traditional vendor management approaches and adopt robust, AI-driven TPRM frameworks that continuously monitor, assess, and mitigate risks across all third-party relationships.

Effectively managing third-party risk requires a structured approach that goes beyond one-time assessments. Organizations must implement a comprehensive strategy that ensures risks are continuously identified, monitored, and mitigated throughout the vendor lifecycle. This involves understanding key components that contribute to a strong third-party risk management framework, allowing businesses to safeguard their operations, regulatory compliance, and reputation.

A successful third-party risk management program is not just about setting up a checklist- it’s about integrating risk management into every stage of the vendor lifecycle. Organizations must ensure that they take a proactive approach, recognizing that vendors can introduce both significant value and considerable risk.

An effective third-party risk management methodology ensures that organizations can systematically identify, evaluate, and mitigate risks while maintaining operational efficiency. This involves three core steps:

Before businesses can mitigate third-party risks, they must first understand and identify them. Many organizations mistakenly assume that risk assessments are a one-time activity conducted during vendor onboarding. However, risks evolve over time, making continuous monitoring essential to a robust TPRM strategy.

The primary third-party risk categories include:

To effectively manage third-party risks, businesses must categorize potential threats based on their source and impact. Organizations should ask:

The answers to these questions can help define a tailored approach to risk management.

Successfully identifying third-party risks requires a combination of advanced technology, structured methodologies, and proactive oversight. Organizations must move beyond static assessments and implement dynamic, real-time monitoring tools that provide actionable insights.

By leveraging these tools, organizations can identify, assess, and mitigate risks proactively, reducing the likelihood of costly vendor-related disruptions.

Building a Third-Party Risk Management (TPRM) program is not just about meeting compliance requirements- it’s about protecting business operations, securing sensitive data, and ensuring vendor reliability. An effective TPRM program must be structured, scalable, and adaptable to the ever-evolving risk landscape.

By integrating automation, governance, and strategic risk prioritization, organizations can ensure that their TPRM program is both comprehensive and adaptable to new and emerging risks.

Risk assessments form the backbone of an effective TPRM program. However, traditional assessment methods, such as periodic questionnaires and manual evaluations, are no longer sufficient in today’s dynamic risk environment. Businesses must embrace continuous, intelligence-driven risk assessments to remain ahead of potential threats.

A well-executed risk assessment process ensures that businesses are not just identifying risks but actively managing and mitigating them before they lead to financial, operational, or reputational damage.

The biggest challenge today is no longer gathering vendor risk data- it’s understanding and acting on it. Organizations must shift from proving due diligence to taking meaningful action. This means integrating TPRM into enterprise-wide risk management, using AI to cut through noise and prioritize real risks, and leveraging historical data to enhance incident response.

With increasing regulatory pressure and evolving cyber threats, businesses must invest in intelligent, automated TPRM solutions that enhance decision-making and drive resilience. By embracing this mindset, enterprises can transform TPRM from a compliance exercise into a strategic advantage, ensuring long-term security and operational continuity.

Ready to take your TPRM program to the next level? See how Risk Cloud is revolutionizing third-party risk management. Book a demo today.

Introduction to NIST CSF 2.0 The acronym NIST CSF has become synonymous with cybersecurity risk management since its…

In a time where data breaches and privacy concerns dominate headlines, Data Privacy Day serves as a call…

With the increasing reliance on digital infrastructure, regulatory bodies are stepping up to ensure these institutions are not…