Enterprise Risk Management

Quickly assess and take action on your organization’s biggest risks with a connected view of risks and controls.

Your company might meet the limited regulations of today, but are you ready move quicky when regulations ramp up? Risk Cloud gives companies of all sizes the enterprise-level power to manage risk and adapt to changing regulations, so you’re ready for whatever comes your way.

See For YourselfFinTech is a huge target for cybercriminals. And consumers and lawmakers are pretty demanding when it comes to privacy — rightfully so. Identify security gaps, solidify your defenses, and set up response protocols with Risk Cloud.

See the Difference with Risk Cloud

When the auditors come knocking, you’ll be ready. As a holistic GRC platform, Risk Cloud has robust audit reporting, documentation, and sign-off features that ensure your internal audits will catch issues before the auditors are at your door.

View Internal Audit Solution Brochure"In today's fast-paced business landscape, efficiency is paramount. Partnering with LogicGate, we've embarked on a journey to streamline our processes while championing diversity and inclusion. One notable success story lies in our approach to tier 2 diverse spend collection, designed by Harshila Gujar from the Federal Home Loan Bank of San Francisco. Traditionally, this process was labor-intensive, requiring days of manual effort to compile data and ensure compliance. Recognizing the need for change, we leveraged automation to revolutionize our approach and adopted LogicGate's Supplier Risk Management solution. What once consumed days of work now takes mere hours, thanks to our innovative solution.

But our efforts go beyond mere efficiency gains. By documenting and sharing our process and outcomes through a thought leadership lens, we're setting a precedent for the industry. We're not just automating tasks; we're championing diversity and inclusion in subcontractor relationships. In essence, our journey exemplifies how technology, when wielded thoughtfully, can serve as a catalyst for progress. Together, let's continue driving diversity and inclusion, one automated process at a time."

- Harshila Gujar, Procurement Operations and Vendor Risk Manager at Federal Home Loan Bank of San Francisco

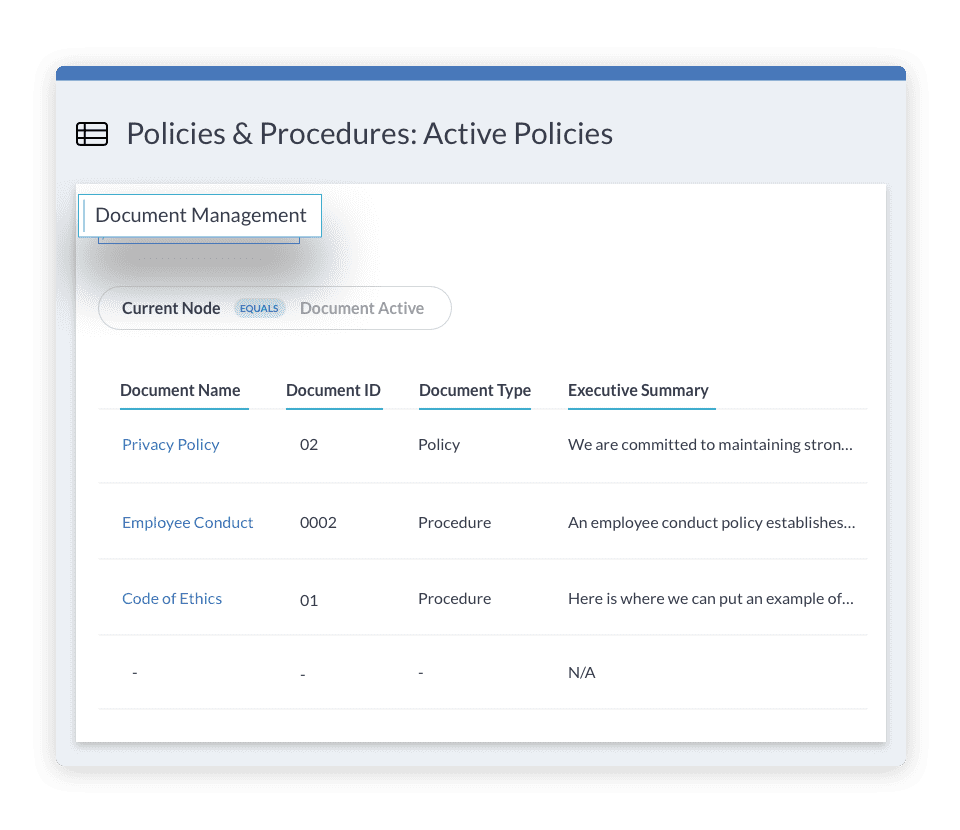

Quickly assess and take action on your organization’s biggest risks with a connected view of risks and controls.

Identify, quantify, and prioritize cyber risks by linking vulnerabilities and threats to expected business impact.

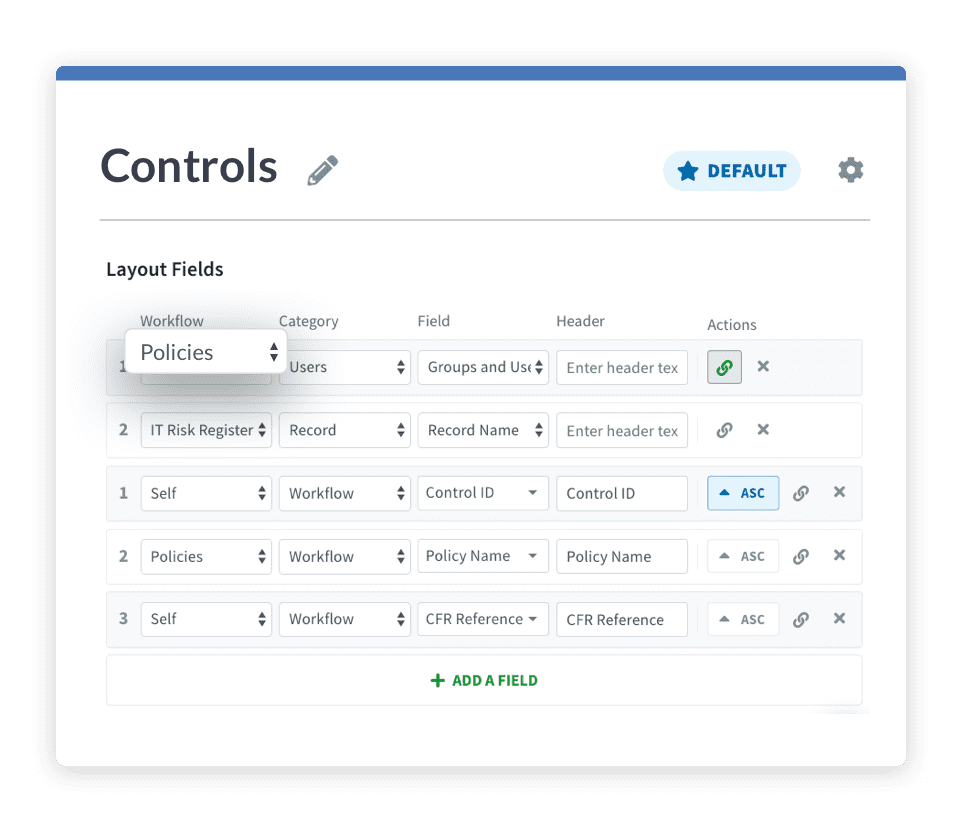

Eliminate redundant controls and improve program efficiency by dynamically linking risks, controls, assessments, and evidence.

If you want your GRC engine to run smoothly, you need to look at systems holistically. Create a…

Uphold identified LogicGate’s Risk Cloud platform as the all-encompassing platform they needed and has been able to leverage…

Requirements across security frameworks must evolve to account for new technology and safeguard against the latest threats. Serving…

Introduction to TPRM As businesses continue to rely on third-party vendors for critical services, the need for a…

Introduction to NIST CSF 2.0 The acronym NIST CSF has become synonymous with cybersecurity risk management since its…